Art tied to a non-fungible token or NFT is becoming increasingly valuable with demand steadily rising. But how can a digital picture be valuable if the file can be copied and saved easily? If anyone can right-click and copy-paste the image, why do NFTs have value?

NFTs have value because an underlying, unchangeable blockchain record can prove their ownership and uniqueness. Once secured by smart contracts, market factors like scarcity, liquidity, network effect, utility, buyer perception, and the hype factor contribute further to their worth.

This guide will shed more light on the aforementioned factors contributing to an NFT’s value. Whether you’re an NFT flipper or collector, keep them in mind as you try to evaluate different NFT art to add to your collection.

1. Why Scarcity Makes NFTs More Valuable

Technically, things are more valuable when they are scarce. There are only 59 Le Bron James dunking NBA Top Shots (one sold for a whopping $387,000) and only one Mona Lisa.

Though you may be tempted to believe that any digital file or image is easily copied, NFTs, or non-fungible tokens, are a unique class of digital assets specifically designed to be rare and one-of-a-kind.

What makes NFTs so special is their inherent scarcity – due to their digital nature, NFTs can never be duplicated or “played out.” As a result, NFTs often have higher perceived value than other digital assets.

This contrasts with fungible tokens, which are not scarce and can be replaced by others of the same type. For example, if you have 10 dollars and I have 10 dollars, we both have the same value.

However, with NFTs, each token is unique and cannot be replaced by another identical version. As a result, owning an NFT assures you that a digital image is exclusively yours and unique among any copies made.

2. The Liquidity Premium: Why High Liquidity Increases The Value of NFTs

The liquidity premium is the value that investors assign to an asset based on its ability to be sold quickly and easily. In general, the more liquid an asset is, the higher its price. This is because investors are willing to pay a premium for assets that can be converted to cash quickly (meaning there are a lot of potential buyers of the asset) and without any problems.

One of the features of NFTs with high liquidity is a high trading volume, low transaction costs, easy-to-use trading platforms, and a well-developed secondary market.

By having these features, these NFTs are easier to buy and sell quickly and reliably, making them more valuable in the eyes of buyers. As a result, such NFTs often fetch a higher price than others.

3. Why NFTs have Value: The Network Effect

A network effect is when the intrinsic value of a product or service increases as more people use it. The classic example of a network effect is Facebook – the social media platform is only valuable because so many people use it. The more users the platform has, the more valuable it becomes for everyone involved.

NFTs can also have a network effect, where the value of one NFT increases as more collectors buy and trade their unique pieces of artwork.

One example of an NFT with a strong network effect is the CryptoKitty. CryptoKitty is a digital cat art collection that can be bred, collected, and traded by users on the Ethereum blockchain. The value of CryptoKitty has linearly increased with its popularity.

NFTs with strong community support will typically be more valuable than those without it. Again, for example, the CryptoKitty project’s Discord community is filled with fervent fans of the art.

Projects or collections with less-involved members tend not to produce long-lived NFT-secured art pieces that do not rise in value.

4. Why Utility Gives NFTs Their Value

In addition to the network effects and scarcity that NFTs possess, they also have tremendous utility value. Utility is the value that an asset provides to its holder.

The more useful an asset is, the more valuable it will be. This is because people are willing to pay more for assets that have a higher utility or provide more benefits. NFTs sometimes include the utility of access.

For example, some NFTs like Gary Vaynerchuk’s VeeFriends are digital collectibles that include access to future special events and even Gary himself. Owners can buy and sell these unique characters like traditional collectibles, but they are also trading the underlying utility of the artwork.

Other NFTs are used as gaming assets, which can be traded or used in video games to provide a unique gaming experience. These in-game assets are useful bits of artwork providing gamers new capability.

When assessing the value of an NFT, also determine its utility. NFTs with a lot of utility value tend to have more worth.

5. Security and Transparency

NFTs have several built-in security features that make them much more valuable.

For example, they are secured using cryptography, making them virtually impossible to hack or steal. They also have a public ledger that records every transaction made on the blockchain and allows users to trace their origin and verify ownership.

In addition, NFTs are transparent and open for inspection by anyone on the blockchain. This means that everyone has access to information about a particular NFT, which helps to create trust in its value. As a result, NFTs offer more security and transparency than other digital assets, making them more valuable in the eyes of investors.

6. Perception of The Buyer (What Is The NFT Worth To You?)

It’s crucial to acknowledge that not everybody sees value in financial terms. Art on your wall may be a reproduction of a famous painting carrying the theme of your space, but other collectors may want an original and authentic piece that they don’t plan to sell. They have a completely different way of deriving value. Generally, most of them make emotional decisions instead of rational or for-profit maximization.

For example, a person attending a soccer match may spend thousands of dollars on premium tickets because they are a huge fan and believe it is a great deal. On the other hand, thousands of dollars on such a ticket is a waste of money for those who are not soccer fans.

Similarly, while finding an ultra-rare Pokemon card is meaningless to some, it is a goldmine for some fanatic collectors.

All commodities in any marketplace have values based on the target consumer’s desires and likes.

7. The Hype-Factor

What if that NFT is an NBA Top Shot moment you bought because it reflects the player’s court-side attendance to a game or a recent goal scored by your favorite soccer player?

The idea of “owning a trending moment” reflects monetary value. The real-world value is relative to the group of people interested in it and reflected through price in a way that many audiences can interpret, only adding to its legitimacy.

Known artists typically cultivate fanbases and then create trends associated with their art to help increase their value. If an artist can cultivate enough interest, people will always buy, collect and trade works to try and associate with the moment or trend. Zora’s platform is designed to specifically address this and provide tools for artists to further cultivate their community of fans.

Today, people no longer want competitive pricing or quality products — they want a connection between their unique interests, style, needs, and the creator or issuer. The ability to cut through the clutter with marketing and trends that truly resonate is what grabs consumer attention and sets the winners apart.

Issuers that concentrate on individuality create connections with buyers on an emotional level. And once the consumers associate the creator or trend with positive emotion, loyalty and engagement increase, which increases demand and, eventually, the value of the NFT.

Let’s discuss the basics of ‘fungibility’ or NFTs. Read on if this NFT art phenomenon is still a bit cloudy. This will help you further understand the value of NFTs.

Understanding Non-Fungible Tokens

An NFT is a one-of-a-kind digital signature that can be attached to an asset. Whether it’s a song, an image, or a video, the unique digital signature is like a fingerprint that contains information such as who created the asset, when it was made, and any future sale conditions.

These digital signatures are stored in a blockchain. This is a vast public database that tracks and records the movement of all its assets. If anybody agrees to sell an asset, all participating nodes verify and authenticate that the item was sold and the digital signature was transferred to someone else.

Though the digital assets have been around for a while, they took off recently when the National Basketball Association released NFT-based trading cards. They were known as NBA Top Shots.

So, what is the connection between NFTs and artists?

How Artists Use NFTs

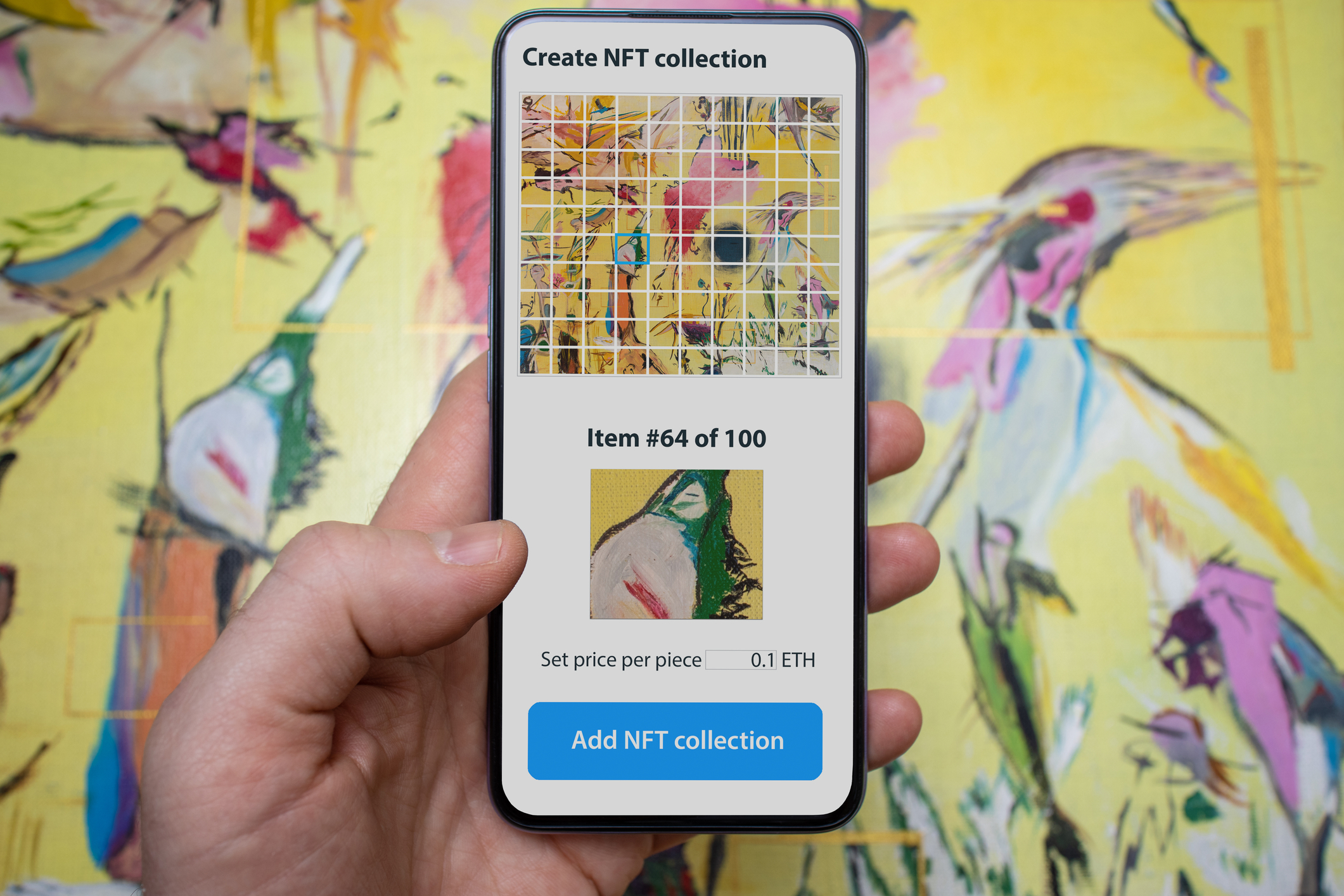

Digital artists who have designed and created artwork in Adobe Photoshop or any other NFT creating software use websites such as Rarible and OpenSea to sell their work.

The process of creating an NFT is called minting. After creating the item you want to sell, you can list it out on your preferred digital marketplace and then attach a specific commission so that anytime someone buys it, you get paid.

Initially, there was no way to differentiate a digital asset’s “original owner” from somebody who just saved a copy. NFTs solve this issue by giving owners a deterministic and immutable (unchangeable) record on a secure and open ledger (blockchain), representing ownership.

This provenance or history makes it possible for transactions to happen in innovative ways that are more valuable and efficient.